1. Inflationary Adjustments:

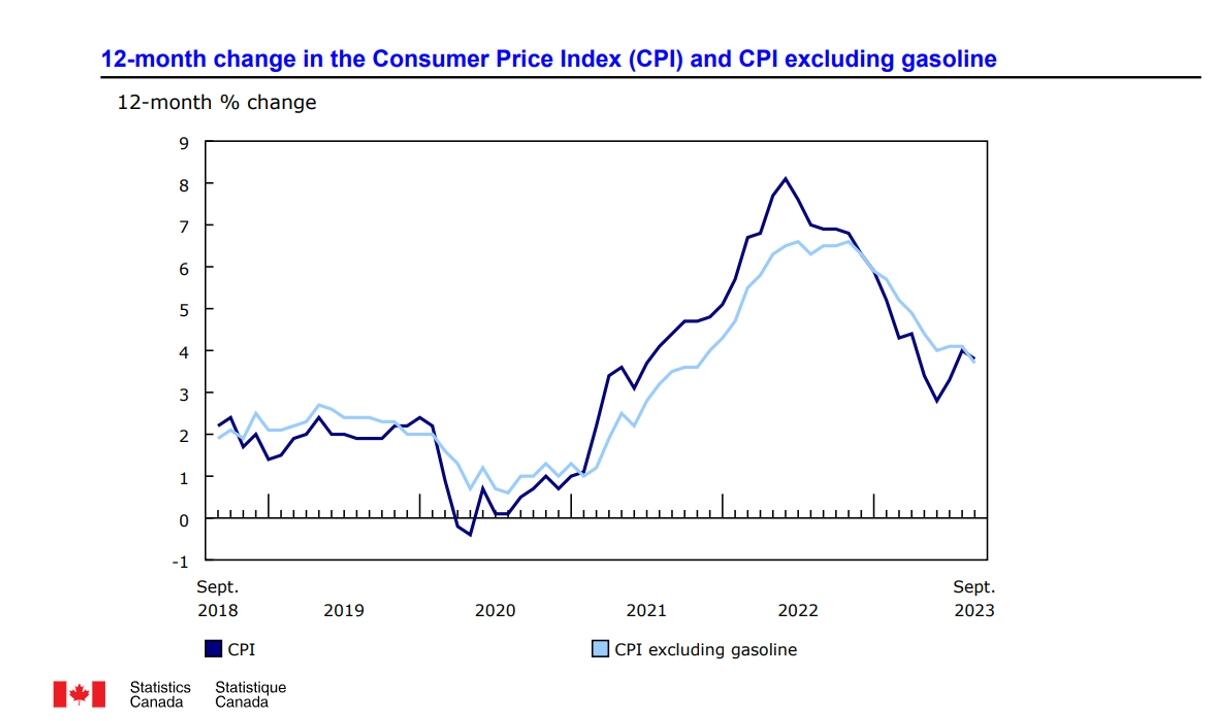

Canada's Consumer Price Index (CPI) increased by 3.1% in the past year, exhibiting a marginal moderation from the preceding month.The primary contributor to this deceleration is the noteworthy 6.4% drop in gasoline prices for October, resulting in a 7.8% decrease compared to a year ago.

2. Food Price Dynamics:

Food prices experienced a 5.4% increase over the past year, marking a moderation from the 5.8% annual pace in September.

Despite this, grocery bills remain elevated, with a persistent more than 20% surge over the last three years—a historic high.

3. Escalating Shelter Costs:

Shelter costs, constituting a significant portion of household budgets, rose by over 6% in the past year—twice the overall inflation rate.

Rent, in particular, surged by 8.2%, outpacing the 7.3% increase recorded in September.

4. The Impact on Consumer Spending:

The relentless rise in shelter costs is constraining household budgets, leading to a drop in per capita consumer spending.

Discretionary spending is notably affected, particularly for those dealing with higher mortgage payments.

5. Bank of Canada's Policy Implications:

Economist Tu Nguyen suggests that the CPI report provides the Bank of Canada with a rationale to hold off on further rate hikes.

The cooling economy, evident in the CPI data, allows the Bank to adopt a patient stance and let existing monetary policies influence economic dynamics.

Conclusion:

While inflationary pressures exhibit nuances across sectors, the overarching narrative involves a balancing act between moderating factors like gasoline and escalating elements such as shelter costs.

The Bank of Canada's decision to maintain the status quo reflects a nuanced understanding of the multifaceted economic landscape and a strategic approach to monetary policy in response to evolving economic indicators.