The Bank of Canada recently made a significant move, or rather, chose not to make one. In a departure from its usual pattern of rate hikes, the Bank has decided to keep its overnight rate steady at 5%. This decision signals a marked shift in the Bank's approach towards managing inflation, which has been a hot topic for both policymakers and the public.

Senior Deputy Governor Carolyn Rogers stated that the Bank is now sufficiently convinced that inflation is moving in the right direction. This newfound confidence means they're less focused on rate hike possibilities. Instead, the conversation is turning towards how long the current interest rates will remain in place.

Governor Tiff Macklem, while not giving away any specifics, emphasized the need to allow the current high interest rates time to take effect. The market predicts a stabilization period of four to six months, but this could vary, as historical trends have shown rate peaks lasting from a few months to over a year. Up until now, it's been half a year since the last rate increase.

While a further hike in rates isn't off the table, it's an uncommon scenario for the Bank of Canada to engage in a pattern of hike-pause-hike over extended periods. Upcoming CPI reports, especially the one due on February 20th, will be crucial. If these reports show expected progress on inflation, we might see a continued decrease in yields. But for now, the focus is on the economic data coming out of the U.S., particularly the GDP and core PCE.

Recent inflation trends have been worrisome. The Bank’s preferred trim and median measures indicate an uptick from an average 2.5% pace to 3.6% annualized in recent months. However, the Bank of Canada is hopeful that this spike will be temporary. They project a slight decrease in the annual CPI over the next two years.

Despite these hopeful signs, the Bank is cautious. They're looking for a more sustained period of core inflation within the 2% range before considering any rate reductions. Macklem has suggested keeping a close eye on GDP growth, which the Bank forecasts to be modest in the coming years.

The next GDP report will be particularly telling, especially since the Bank is expecting negligible growth. This scenario borders on the risk of a technical recession, which would only add to the pressures for a more dovish policy stance.

One factor that’s contributing significantly to inflation is the rising cost of mortgages and rents. This increase is more pronounced than in previous episodes of monetary tightening. With the ongoing immigration and limited housing supply, these costs might remain high, potentially prolonging the period of elevated interest rates.

However, a significant portion of mortgage holders are expected to face financial strain due to increased debt-servicing costs. This could offset some inflationary pressures. The National Bank Financial reports that the Bank of Canada anticipates around half of the inflation in the next two years to be driven by housing costs.

Finally, there's a ray of hope. We've passed the toughest phase of monthly inflation comparisons, which should aid in making progress on the annual rate. Tony Stillo of Oxford Economics suggests that if month-over-month inflation averages 0.2% or less this year, we might hit our inflation target by year-end.

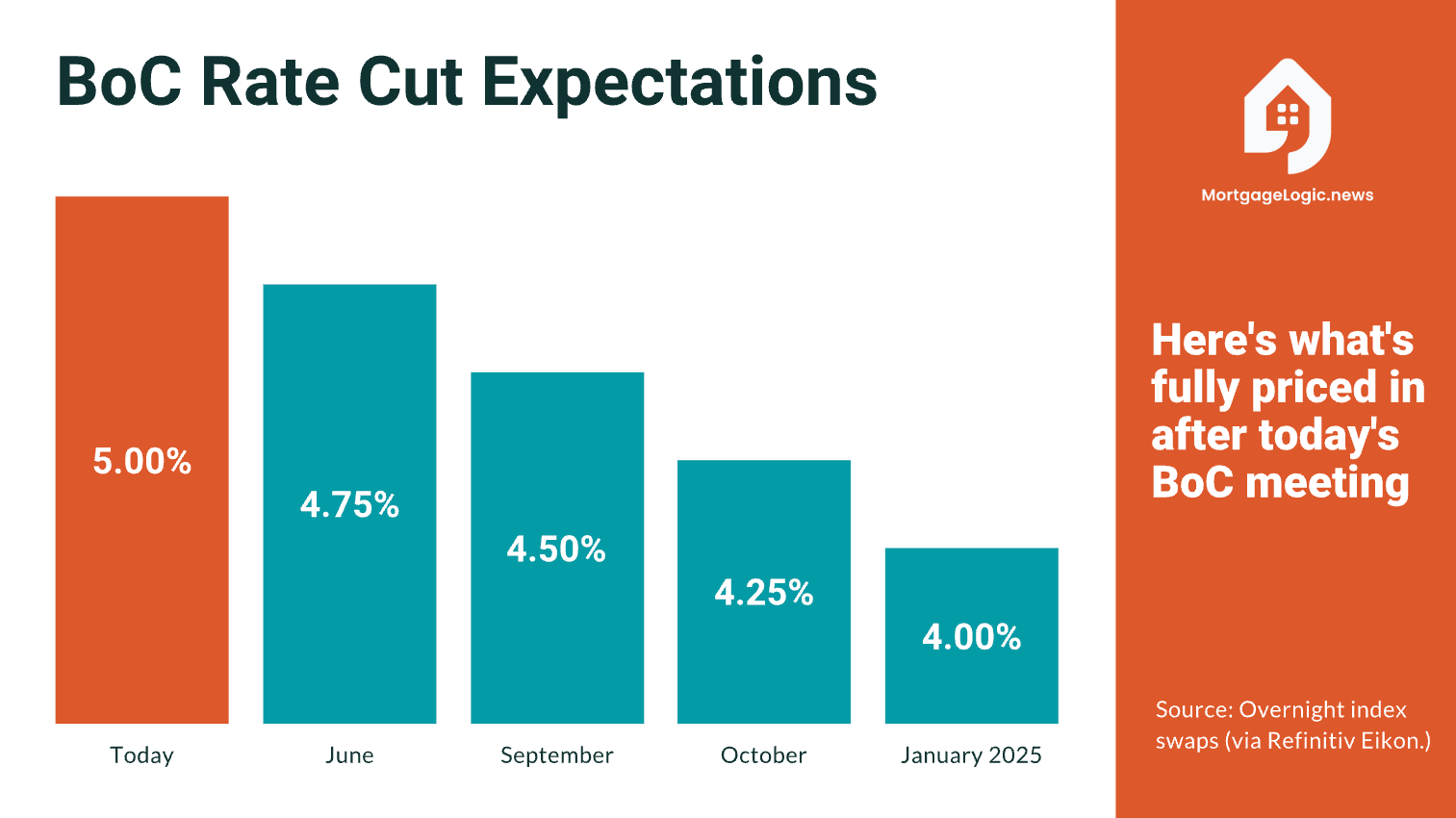

Still, numerous factors, like immigration, wage growth, supply shocks, and real estate activity, could derail this trajectory. Economically, the most likely scenario seems to be a gradual decline in prices leading to a rate-cut cycle later in the year.

For those with mortgages, it might be wiser to consider shorter fixed-term options rather than variable rates in these uncertain times. All in all, while the Bank of Canada's decision to hold rates steady brings some stability, the economic landscape remains complex and fluid, warranting close monitoring in the coming months.