New Mortgage Rules: Making Homeownership More Accessible for Canadians

Posted on Sep 17, 2024

On September 16, 2024, the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, announced sweeping reforms to mortgage rules aimed at making homeownership more affordable and accessible for Canadians, particularly Millennials and Gen Z. These changes are part of a broader strategy to address the housing crisis and help more...

Navigating Real Estate in a Shifting Economy: Impact of Interest Rates and Inflation

Posted on Aug 21, 2024

As the summer heats up, so does the real estate market, albeit in unexpected ways. Recent inflation data from Statistics Canada reveals a cooling trend in price increases, providing both challenges and opportunities for potential homeowners and real estate investors. Here’s a closer look at the current economic landscape and what it means for the h...

New Tenancy Rules in British Columbia: What You Need to Know

Posted on Jul 08, 2024

As of July 18, 2024, significant changes to British Columbia’s Residential Tenancy Act have come into effect. These updates aim to create a more balanced and fair rental market, addressing long-standing issues that have affected both tenants and landlords. Here’s a comprehensive overview of the key changes and what they mean for you.

Increased Notic...

BC Government Introduces Key Changes to Property Transfer Tax to Enhance Housing Affordability

Posted on Feb 23, 2024

In a significant move to tackle housing affordability issues, the Government of British Columbia has announced three major changes to its Property Transfer Tax (PTT) framework as part of the 2024 provincial budget.

Firstly, the threshold for the first-time homebuyers’ exemption is set to increase substantially, rising from a fair market value of $50...

Understanding the Extension of Canada's Ban on Foreign Home Purchasing

Posted on Feb 16, 2024

The recent announcement by Finance Minister Chrystia Freeland regarding the extension of the ban on foreign home purchasing in Canada has sparked discussions about its impact on housing affordability and its effectiveness as a policy measure.

Initially introduced in 2022, the ban prohibits foreign nationals and commercial enterprises from buying res...

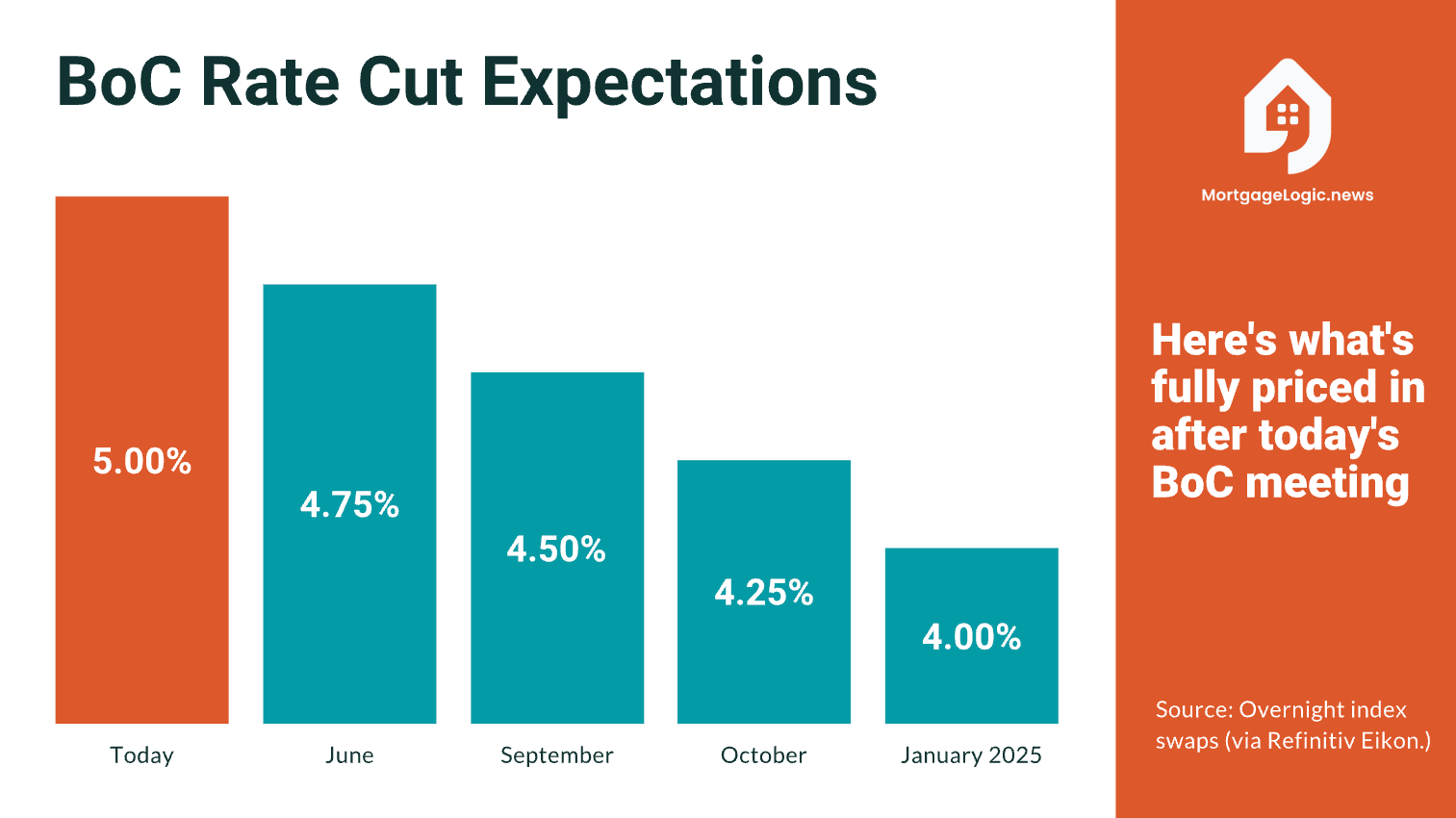

Bank of Canada Pauses Interest Rate Hikes: A Deeper Dive into What It Means

Posted on Jan 26, 2024

The Bank of Canada recently made a significant move, or rather, chose not to make one. In a departure from its usual pattern of rate hikes, the Bank has decided to keep its overnight rate steady at 5%. This decision signals a marked shift in the Bank's approach towards managing inflation, which has been a hot topic for both policymakers and the pub...